It has been 23 years since CRCSD asked the community to approve a bond. The district has been fiscally responsible and leveraged local option sales tax revenue and PPEL funds to maintain our facilities and build 3 new elementary schools. As our buildings continue to age, the cost of upkeep will continue to rise. The cost of construction also continues to rise each year, outpacing inflation. We want to re-establish our competitive edge and city pride in our district. Updated facilities will offer safe, secure, and equitable learning environments for all students. Adding Career and Technical Education (CTE) opportunities to our high schools will allow our students to be college and career-ready when they graduate.

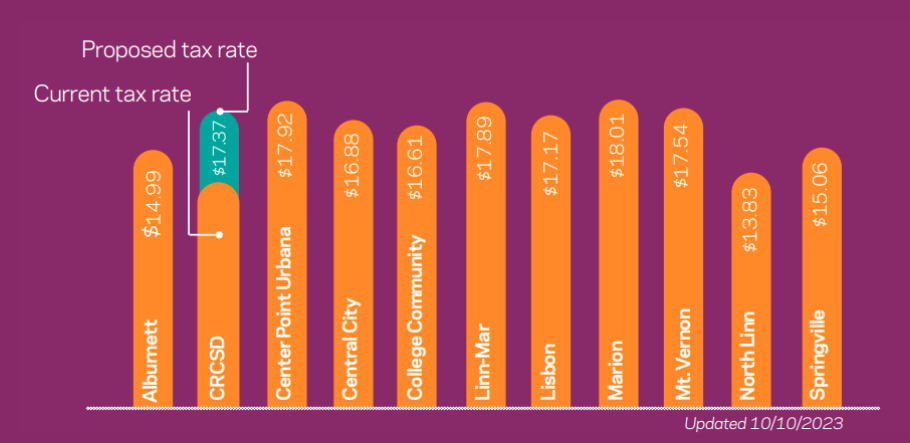

To take the next step, which will focus on middle school and high schools, the district is asking voters for a $220 Million GO Bond in the November 2023 election. If approved, it would raise the district’s property tax levy by $2.70 per $1,000 of taxable value. The final taxable value of your property is a percentage of its assessed value after credits. Even with this increase, the CRCSD’s property tax levy rate would remain comparable to or less than many neighboring school districts.

Bond Language

Below is the official bond language that will appear on the November 7th ballot.

Shall the Board of Directors of the Cedar Rapids Community School District in the County of Linn, State of Iowa, be authorized to contract indebtedness and issue General Obligation Bonds in an amount not to exceed $220,000,000 to provide funds to: a) construct, build, furnish, and equip a new Middle School building and acquire and improve the site; b) renovate, remodel, repair, improve, furnish and equip kitchen/café spaces at the Kennedy High School building; c) construct, furnish, and equip Career and Technical Education additions to Jefferson, Kennedy, and Washington High School buildings and related remodeling; d) install turf fields and other site improvements at Jefferson, Kennedy, and Washington High School locations; e) construct, build furnish, and equip a gymnasium addition to Metro High Middle School building and related remodeling; and f) renovate, remodel, repair, improve, furnish and equip Franklin Middle School building and construct, furnish, and equip an addition to Franklin Middle School building and related remodeling?

Tax Impacts

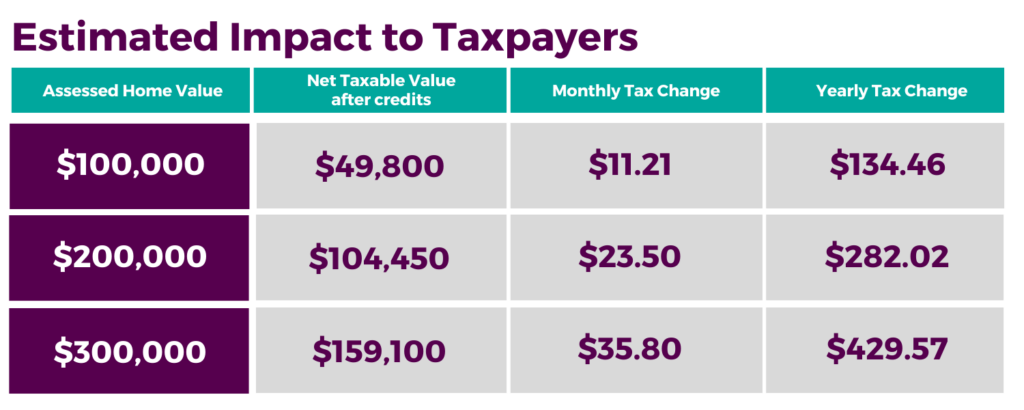

If approved, the bond would increase the district’s tax levy rate by $2.70 per $1000 of taxable value. The final taxable value of your property is a percentage of its assessed value after credits. Below is a table showing the tax increase for homes of various taxable values.

CRCSD is the 2nd largest school district in the state of Iowa but has one of the lower tax rates across the state. Currently, Cedar Rapids Community School District’s tax levy rate is lower than the majority of the schools in Linn County. Even with the proposed bond increase, the district’s tax levy rate would still remain comparable to or less than many neighboring districts.

Bond Timeline

- July 18, 2023 – New Comprehensive Master Plan presented to the community and approved by the Cedar Rapids Community School District’s Board of Education. Click here to read more about the presentation.

- July 27, 2023 – CRCSD hosts the City of Cedar Rapids mayor and city council members for a joint meeting to discuss the Facilities Master Plan. Click here to learn more about the meeting.

- August 1, 2023 – CRCSD Board of Education votes to move forward with Facilities Master Pan and proposed $220 million bond referendum in November. Click here to learn more.

- August 8, 2023 – The Board of Education approves petition language for the proposed $220 million bond referendum. Click here to read more.

- September 22, 2023 – The community gathered the needed 6,319 petition signatures to put the bond referendum on the November 7, 2023, ballot.

- November 7, 2023 – Proposed bond referendum goes up for community vote.